Core Advantages: Why Sodium Wins on the Balance Sheet – Cost Structure Economics

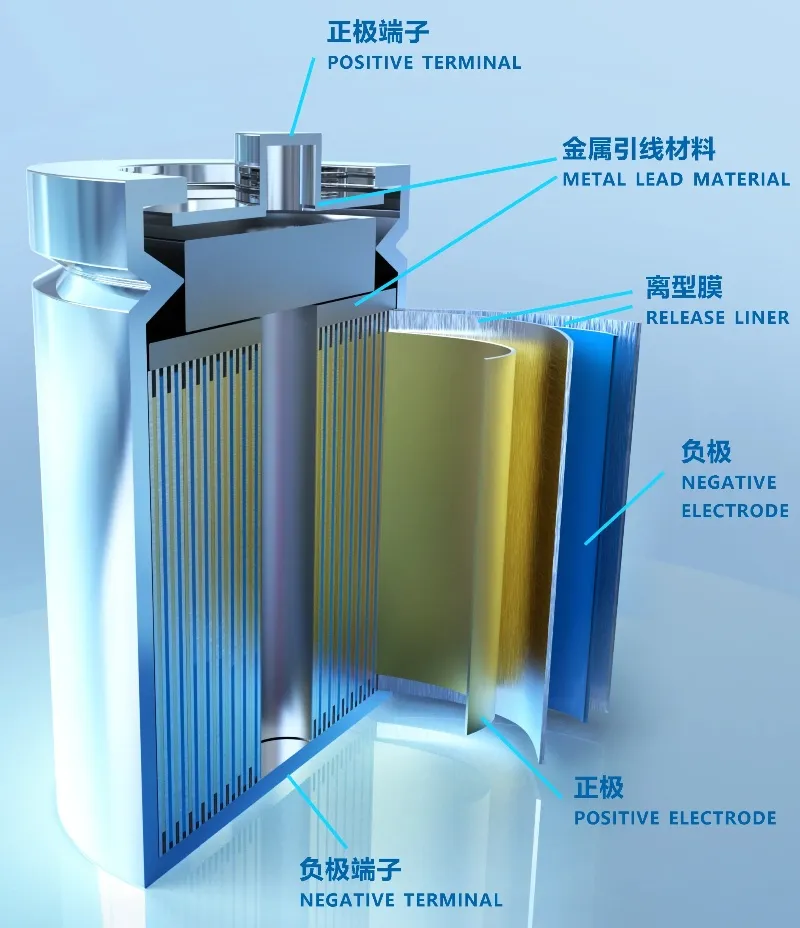

Sodium-ion batteries (SIBs) offer a compelling cost advantage that directly improves the balance sheet for manufacturers and end-users alike. Unlike lithium-ion technologies, SIBs rely on abundant and affordable raw materials, most notably battery-grade sodium carbonate, which currently costs a fraction of lithium carbonate. This supply chain independence translates into lower, more stable material costs across the board.

Key points on sodium-ion cost structure economics include:

- Raw Materials Affordability: Sodium is plentiful and widely available worldwide, reducing exposure to lithium price volatility and geopolitical supply risks.

- Reduced Dependency on Critical Metals: SIBs avoid high-cost cobalt and nickel, instead utilizing hard carbon anode materials and Prussian white cathodes that are less expensive and easier to source.

- Simpler Manufacturing Inputs: The use of aluminum current collectors instead of heavier copper further cuts raw material expenses, improving overall cell economics.

- Scale-driven Cost Declines: As production scales up, manufacturers benefit from economies of scale, pushing down the levelized cost of storage (LCOS) for grid-scale energy storage systems (ESS) and electric light vehicles (LEVs).

- Competitive Fast Charging and Cycling Stability: Improved fast-charging kinetics and long cycle life reduce total cost of ownership, even though sodium-ion energy density currently sits around 160 Wh/kg compared to lithium-ion alternatives.

In 2026, these cost structure economics position sodium-ion batteries as a strong contender in the post-lithium battery market. By focusing on lower-cost raw materials with stable supply chains, SIBs address one of the industry’s largest financial headaches—raw material price swings. This makes them a practical solution for budget-conscious applications such as micro-electric vehicles (A00 class) and large-scale ESS deployments.

Core Advantages: Why Sodium Wins on the Balance Sheet..Superior Safety Profile

One of the standout benefits of sodium-ion batteries (SIB) is their superior safety profile compared to many lithium-ion alternatives. Sodium-ion technology significantly reduces risks related to thermal runaway, a common issue causing fires and explosions in lithium-ion batteries. This makes SIBs a more reliable option, especially for applications where safety is critical, such as grid-scale energy storage systems (ESS) and micro-electric vehicles (A00 class).

Sodium-ion batteries use materials like hard carbon anode materials and Prussian white cathodes, which are less reactive and more stable under extreme conditions. This contributes to better thermal management and improved low-temperature battery performance, essential for cold climates or outdoor ESS units.

In addition, sodium-ion cells often feature aluminum current collectors. These are lighter and less prone to dendrite formation than the copper commonly used in lithium cells. This further boosts safety. Together, these factors lower the overall risk profile while delivering dependable performance. As a result, sodium-ion batteries become a smart choice where safety and cost balance are priorities.

For manufacturers exploring material options and cathode development, insights into the dry grinding process can be crucial for producing high-quality battery powders that support these safety advantages.

Core Advantages: Why Sodium Wins on the Balance Sheet..Performance in Extremes

Sodium-ion batteries (SIBs) shine when it comes to performing in extreme conditions. Unlike many lithium-ion alternatives, sodium chemistry maintains stable operation across a wide temperature range—from intense cold to blazing heat. This makes them ideal for applications in harsh climates or fluctuating environments. They also offer reliable fast-charging kinetics even at low temperatures. This is a significant advantage for outdoor and off-grid uses.

This resilience means fewer energy losses and better cycle life under stress, contributing to lower total cost of ownership. Plus, the thermal runaway prevention inherent in sodium-ion systems boosts safety without compromising power output. In short, when extreme temperature or rapid charge demands push other battery chemistries to their limits, SIBs keep delivering consistent, dependable performance.

Leveraging advanced materials such as hard carbon anode materials and Prussian white cathodes further enhances this durability. As a result, sodium-ion batteries emerge as a top contender in emerging markets that require robust energy solutions. For manufacturers, this translates into expanded market opportunities. These opportunities are especially evident in grid-scale energy storage systems (ESS) and micro-electric vehicles (A00 class) operating in varied environments.

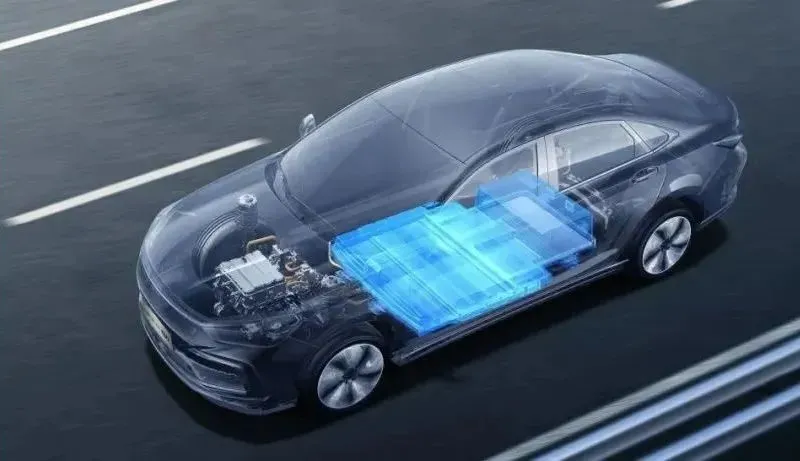

Strategic Positioning in 2026: The ‘Low’ End – Two-Wheelers and LEVs

By 2026, sodium-ion batteries (SIBs) are carving out a strong foothold in the low end of the electric vehicle market. This is especially true for two-wheelers and light electric vehicles (LEVs). These micro-electric vehicles (A00 class) benefit from the cost structure, safety profile, and decent performance of SIBs. This makes them ideal for urban mobility solutions where affordability and reliability come first.

Two-wheelers and LEVs typically do not demand the highest energy density. Instead, they prioritize fast-charging kinetics and thermal runaway prevention. These are two areas where sodium-ion technology shows strong promise. The abundant availability of battery-grade sodium carbonate and the use of hard carbon anode materials also enhance supply chain independence. This further reduces overall costs. As a result, SIB-powered vehicles become more accessible in price-sensitive markets.

With lower energy density requirements than full-sized EVs, this sector acts as a prime entry point for sodium-ion technology. It allows manufacturers to leverage drop-in manufacturing strategies without significant redesign of existing battery packs. This approach supports rapid scale-up to meet growing urban transportation needs.

As these vehicles become increasingly popular worldwide, especially in emerging markets, sodium-ion batteries are set to become the go-to choice for two-wheelers and LEVs. They balance affordability, safety, and good cold-climate performance. This positions them strongly within a growing segment of the post-lithium battery market.

For detailed insights on optimizing powder materials used in battery manufacturing, exploring advanced processes such as spherical silica preparation can be valuable. These material science advances link directly to performance improvements. For more on powder technology, review advanced methodologies in spherical silica processing and powder classification technology. These approaches are increasingly relevant to improving battery-grade material consistency.

Strategic Positioning in 2026: The ‘High’ Volume: Energy Storage Systems (ESS)

By 2026, sodium-ion batteries (SIB) are carving out a major role in grid-scale energy storage systems (ESS). Their cost advantage and battery supply chain independence make them a strong fit for large-scale ESS projects, where low Levelized Cost of Storage (LCOS) is king. Sodium-ion technology provides a more affordable alternative to lithium-ion, especially lithium iron phosphate (LFP), without compromising on reliability.

SIBs excel in stable, long-duration storage with thermal runaway prevention and robust low-temperature battery performance. This reliability is crucial for ESS applications that support renewable integration, peak shaving, and grid resilience. The use of abundant and locally available battery grade sodium carbonate helps reduce supply chain risks tied to lithium shortages or geopolitical constraints.

Moreover, sodium-ion’s compatibility with layered oxide cathodes, including Prussian white cathodes, ensures competitive cycle life and scalability. The drop-in manufacturing approach facilitates an easier transition for existing battery factories to adopt sodium-ion for ESS production, accelerating market uptake.

For companies focused on expanding their ESS footprint, sodium-ion batteries offer a strategic edge—balancing cost, safety, and performance in a growing post-lithium battery market. This is particularly relevant when exploring innovations like resource utilization of lithium-containing electrolytic aluminum slag, which aligns with sustainable battery production cycles.

In , sodium-ion’s strategic positioning in the ‘high’ volume ESS market is expected to boost its adoption, strengthening the global transition toward affordable, safe, and scalable energy storage solutions by 2026.

Strategic Positioning in 2026: Complementary, Not Competitive

In 2026, sodium-ion batteries (SIB) aren’t about replacing lithium-ion but complementing it. Their strategic positioning focuses on filling market gaps where each technology plays to its strengths rather than competing head-on. Sodium-ion’s cost-effective materials like battery-grade sodium carbonate and robust hard carbon anode materials offer an attractive option for lower-cost applications, while lithium-ion, particularly with LFP (Lithium Iron Phosphate), holds ground in high energy density and premium performance sectors.

This ‘high-low’ market split means sodium-ion powers segments like two-wheelers, micro-electric vehicles (A00 class), and grid-scale energy storage systems (ESS), where affordability, thermal runaway prevention, and stable performance under temperature extremes matter most. Meanwhile, lithium-ion remains preferred for electric vehicles needing maximum energy density and fast charging kinetics.

The two technologies are thus strategic partners in the post-lithium battery market, addressing different needs without cannibalizing each other. This complementary relationship encourages investment and innovation across the battery supply chain, enhancing overall market resilience. Advances in materials science, such as layered oxide cathodes for sodium-ion and aluminum current collectors, further solidify this balanced coexistence.

For manufacturing insights around ultrafine powder production that influence battery material quality, check out our detailed overview on high-efficiency ultrafine seaweed powder production in Thailand. This kind of precision processing plays a role in optimizing material properties for next-gen batteries globally.

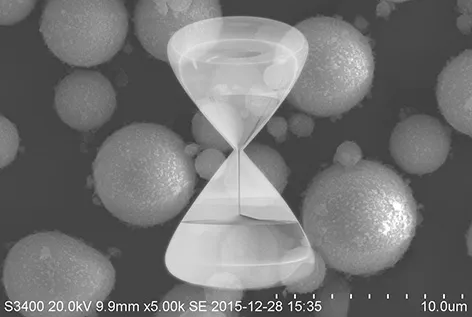

Material Science & Manufacturing: The Epic Powder Perspective..The Cathode Race

In the sodium-ion battery (SIB) space, the cathode is where much of the innovation is happening—often called the “cathode race.” This race is centered around developing advanced materials like Prussian white and layered oxide cathodes that deliver better energy density and longer life. These cathodes rely heavily on high-quality epic powder inputs, which directly affect battery performance and consistency.

Epic powder’s uniform particle size and purity are critical to optimizing the electrochemical reactions in cathodes. For instance, battery-grade sodium carbonate and sophisticated powder classification technology ensure the cathode materials maintain structural stability during charge-discharge cycles. This stability is essential for grid-scale energy storage systems (ESS) targeting long-term reliability and low Levelized Cost of Storage (LCOS).

Moreover, fine-tuning powder surface properties through ultrafine powder surface modification techniques helps improve fast charging kinetics and reduces capacity fading — a key factor for sodium-ion batteries competing with lithium-ion technology. For manufacturers, mastering these powder preparation and classification methods can provide a strategic edge in the post-lithium battery market.

For those involved in cathode material development, exploring advanced ultrafine powders preparation methods is a must. These processes not only refine the raw materials but also elevate the overall performance and scalability potential of SIB cathodes, setting sodium-ion batteries up for success in 2026 and beyond.

Learn more about ultrafine powders preparation and classification technology to see how epic powder innovation is shaping the future of sodium-ion battery cathodes.

Material Science & Manufacturing: The Epic Powder Perspective – The Anode Challenge

One of the biggest hurdles in sodium-ion batteries (SIB) lies in the anode materials. Unlike lithium-ion batteries, where graphite works well, sodium’s larger ion size means traditional anode materials don’t cut it.

Hard carbon anode materials have emerged as the go-to solution. They offer good capacity and relatively stable cycling. However, producing high-quality hard carbon at scale requires precise control over particle size and purity. This is where advanced powder processing steps in.

This is where Epic Powder’s expertise makes a difference. Their refined powder technologies help create consistent hard carbon with optimized microstructure. This is critical for stable performance and fast-charging kinetics in sodium-ion cells.

Achieving uniformity in hard carbon anodes also means better cycle life and less capacity fade. This directly addresses one of the key challenges in growing sodium-ion battery adoption.

Additionally, the use of aluminum current collectors with sodium-ion anodes demands powders that can withstand manufacturing stress without degrading. With Epic Powder’s precise particle engineering, manufacturers can tune the anode’s physical and chemical properties. This supports drop-in manufacturing techniques that ease integration into existing lithium-ion production lines.

To sum up, the anode challenge in SIB technology is being tackled head-on through high-quality hard carbon materials produced with advanced powder processing techniques. This progress ensures sodium-ion batteries can compete on both performance and cost. It is especially important for applications such as grid-scale energy storage systems (ESS), where durability and safety are paramount.

Learn how finely tuned powders play a role in battery-grade material production by exploring innovations in precision powder processing for chemical plants.

Material Science & Manufacturing: The Epic Powder Perspective..Drop-in Manufacturing

One of the biggest strengths of sodium-ion batteries (SIB) lies in how they fit into existing production lines with minimal changes. This represents a true drop-in manufacturing advantage.

Thanks to advancements in materials such as hard carbon anode materials and Prussian white cathodes, manufacturers can often switch from lithium-ion to sodium-ion chemistry without overhauling their equipment. This means companies leveraging Epic Powder technologies for uniform particle size and surface properties can achieve consistent batch quality. Consistency is crucial for stable battery performance.

Using battery-grade sodium carbonate and specialized powder processing methods—such as dry grinding and surface modification—helps optimize layered oxide cathode powders. This improves ionic conductivity and cycle life. Compatibility with current lithium-ion infrastructure reduces capital expenses. It also shortens lead times and accelerates sodium-ion adoption in markets hungry for reliable lithium-ion alternative technologies. The ability to use aluminum current collectors also aligns with drop-in strategies. It avoids the cost and complexity of introducing new materials.

This streamlined manufacturing pathway makes sodium-ion batteries an appealing choice for major players targeting grid-scale energy storage systems (ESS) or electric micro-mobility applications. For more on powder processing techniques that enhance battery material performance, see detailed discussions on surface modification of silica micropowder and the latest centrifugal classifier innovations.

Comparative Analysis: SIB vs. LFP (Lithium Iron Phosphate) – Energy Density Reality Check

When it comes to energy density, sodium-ion batteries (SIB) have traditionally lagged behind lithium iron phosphate (LFP) cells. In 2026, this gap remains notable. However, it is narrowing thanks to advances in cathode materials such as Prussian white and optimized hard carbon anodes. While LFP still leads with higher watt-hour-per-kilogram (Wh/kg) values, modern SIBs now achieve competitive performance. This level of performance suits many applications, especially those where weight is less critical.

Key points to consider in this energy density comparison:

- SIB Energy Density Range: Expect around 120-150 Wh/kg, improving steadily with innovations in layered oxide cathodes and battery grade sodium carbonate sources.

- LFP Energy Density Range: Typically sits between 160-180 Wh/kg, benefiting from mature material science and supply chains.

- Use Case Suitability: SIB’s slightly lower energy density is offset by cost advantages and superior safety in applications like grid-scale energy storage systems (ESS) and micro-electric vehicles (A00 class).

- Performance in Extremes: SIBs maintain stable output even at low temperatures, helping bridge gaps where LFP might struggle with fast charging kinetics or thermal runaway issues.

The energy density reality check highlights that while LFP still holds a density edge, sodium-ion technology’s ongoing improvements make it a viable, often better balanced alternative, especially when factoring in cost structure economics and battery supply chain independence.

For insights into the evolving cathode and anode materials shaping this future, check out the detailed Epic Powder perspective on material grinding technology that supports these advances.

Comparative Analysis: SIB vs. LFP (Lithium Iron Phosphate) – The Cost Cross-Over Point

When we look at the cost cross-over point between sodium-ion batteries (SIB) and lithium iron phosphate (LFP), it is clear that SIBs are gaining an edge as we approach 2026.

The main driver is raw material cost. Sodium, extracted from abundant battery-grade sodium carbonate, is far cheaper and more readily available than lithium. This directly lowers the cost structure of SIBs. It also makes them especially attractive for large-scale applications.

Material Supply Chain Independence: Sodium’s abundance reduces exposure to lithium supply risks. This eases pressure on supply chains and stabilizes prices.

Manufacturing Costs: SIBs benefit from simpler, drop-in manufacturing processes. They use aluminum current collectors instead of copper, which further cuts expenses.

Scale Effects: As production ramps up, economies of scale push sodium-ion battery costs below those of LFP at high volumes. This is particularly evident in grid-scale energy storage systems (ESS).

While LFP still holds some cost advantages in smaller, high-performance segments, the levelized cost of storage (LCOS) for SIBs becomes increasingly competitive. This is especially true where safety and performance in extreme conditions matter. This balance makes sodium-ion batteries a smart alternative as the post-lithium battery market grows.

For a deeper look into manufacturing efficiency and material handling, exploring ultrafine grinding processes and equipment can be insightful. It helps explain how powder quality impacts cathode and anode production.

Overall, the cost cross-over point signals a strategic moment. Sodium-ion batteries are no longer just a lithium-ion alternative technology. They are carving out a clear niche as a more cost-effective solution for large-scale, cost-sensitive applications by 2026.

Comparative Analysis: SIB vs. LFP (Lithium Iron Phosphate) — Cycle Life Projections

When comparing sodium-ion batteries (SIB) with lithium iron phosphate (LFP) batteries, cycle life is a crucial factor for many applications. SIB technology has made significant strides in extending cycle life. It now often matches, and in some cases exceeds, LFP standards under certain conditions.

- Durability: SIBs typically offer 2,000 to 4,000 full charge–discharge cycles. This closely approaches the 3,000 to 5,000 cycles common for LFP batteries.

- Degradation Factors: Hard carbon anode materials and advanced Prussian white cathodes help minimize capacity fade. This is particularly important in low-temperature and high-rate charging scenarios.

- Long-Term Reliability: For grid-scale energy storage systems (ESS), SIBs show strong potential. They demonstrate stable cycle life projections that support lower levelized cost of storage (LCOS).

- Application Fit: LFP remains preferred in many electric vehicles due to its established performance. However, SIB’s improving cycle life opens doors for electric two-wheelers and smaller micro-electric vehicles (A00 class). In these segments, cost and resource independence matter more.

Both battery types follow similar aging patterns. However, ongoing advances in sodium battery materials and manufacturing are closing previous gaps. This is especially true with better refined cathode powders that are essential to cycle stability.

Overall, sodium-ion batteries are fast becoming a viable alternative. They offer competitive cycle life projections while combining cost and sustainability benefits. This comes without major sacrifice in battery longevity.

“Thanks for reading. I hope my article helps. Please leave a comment down below. You may also contact Zelda online customer representative for any further inquiries.”

— Posted by Emily Chen